Hurricane Idalia is a weather event that has gripped the attention of the nation and the world. This climatic phenomenon, with its massive scale and potential for destruction, has sent waves of concern across various populations, particularly those residing in Fort Myers Beach, Florida. This article provides an exhaustive insight into the ongoing situation.

The Unsettling Arrival

On a seemingly ordinary Tuesday afternoon, the residents of Fort Myers Beach, including Scott Martin, were caught off guard by the unexpected announcement from the local police force. The imminent arrival of Hurricane Idalia had prompted the authorities to cordon off the island, preventing its inhabitants from accessing it.

“They’re not permitting anyone on the island,” Martin disclosed in a Facebook post. “It’s hard to imagine that it’s already inundated to this extent. The storm is yet to strike.”

A Dejavu for Scott Martin

For Martin, this unfolding scenario was a haunting reminder of the havoc wreaked by Hurricane Ian in the same area just a year ago in September 2022. At that time, Martin was residing in the heart of Fort Myers. While his vehicle luckily escaped the storm’s fury, his residence was not as fortunate, succumbing to severe waterlogging.

The Visual Account

Visual evidence shared with CNN painted a grim picture of the situation. The images depicted a police officer halting a line of vehicles with the backdrop of violent ocean waves in the distance. The robust winds were causing the palm trees to sway violently, and the incessant downpour was inundating the local thoroughfares.

A video clip provided a closer look at the crisis, showing vehicles, including Martin’s, gingerly navigating through the murky floodwaters that had taken over the streets.

The Resonating Impact of Hurricane Ian

The memory of Hurricane Ian still resonates in the minds of the residents. Aerial footage post-Ian had revealed a landscape of ruin and emptiness, with homes and other buildings having been obliterated.

The Fort Myers Beach, a 7-mile-long island that lies along the Gulf of Mexico, had borne the brunt of Ian’s wrath. The town councilman, Dan Allers, had termed the aftermath as “total devastation, catastrophic.”

The Scale of Destruction

In his conversation with CNN in September 2022, Allers had estimated that nearly 90% of the island had been wiped out in the aftermath of Hurricane Ian. The thought of a similar, if not worse, disaster brought on by Hurricane Idalia is a chilling prospect for the residents.

Key Messages about Hurricane Idalia

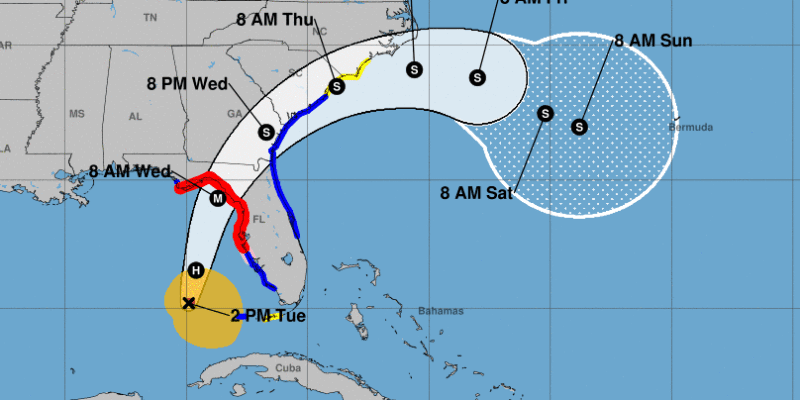

The National Hurricane Center (NHC) has been issuing critical updates about Hurricane Idalia. These updates, known as Key Messages, are designed to keep the public informed about the potential hazards and uncertainties in the forecast.

The NHC encourages the sharing and use of these Key Messages. They are available on the NHC website and social media pages, and include visuals such as the cone graphic, the 34-kt cumulative wind speed probability graphic, and a rainfall forecast graphic.

Please note: The use of this information is subject to certain conditions. For more details, visit www.weather.gov/disclaimer

Latest Updates on Hurricane Idalia

For the most recent updates, forecasts, and trajectories for Hurricane Idalia, stay tuned to WESH 2’s continuous coverage. Additionally, keep a lookout for email notifications about local breaking news alerts.

Preparing for the Storm

Given the unpredictability of the areas that will fall within ‘the cone,’ experts advise Florida residents to be prepared for the storm regardless. Essential steps for hurricane preparedness include protecting oneself and securing one’s home.

immediate surroundings harbor more bacteria than we like to imagine – and not just the usual suspects. The fact is, germs are all around us – it’s their world, we’re just living in it. Often they’re harmless, but not always, and it’s a good idea to avoid taking any unnecessary risks.

immediate surroundings harbor more bacteria than we like to imagine – and not just the usual suspects. The fact is, germs are all around us – it’s their world, we’re just living in it. Often they’re harmless, but not always, and it’s a good idea to avoid taking any unnecessary risks.

Congratulations to Scott Stamper, the CEO of Regency DRT, for receiving the prestigious 2023 Martin L. King Award at the RIA Convention! Scott’s exceptional service and dedication to the restoration field have been recognized by the Restoration Industry Association, and we couldn’t be prouder!

Scott’s invaluable contributions to the restoration industry have made a lasting impact. As the Restoration Council Chair, he has shown exemplary leadership, guiding the industry towards excellence. His involvement in the development of the Fire and Smoke Damage Restoration Standard as a liaison showcases his commitment to setting high standards in the field. The industry owes him a debt of gratitude for his efforts in fostering collaboration between the RIA and the IICRC, bringing about positive changes and advancements.

Scott’s volunteer and leadership roles have been instrumental in shaping the industry. His passion for restoration has driven him to go above and beyond, ensuring businesses get back on track after disasters strike. His dedication and expertise have earned him the respect and admiration of his peers.

We are inspired by Scott’s achievements and proud to have him leading our team at Regency DRT. His visionary approach and unwavering commitment to excellence have propelled us to new heights. Scott’s recognition with the Martin L. King Award is a testament to his outstanding contributions and the positive impact he has made in the restoration industry.

We extend our heartfelt congratulations to Scott Stamper on this well-deserved honor. Thank you, Scott, for your ongoing dedication to the restoration field and for making a difference in the lives of countless businesses and communities.

For exceptional restoration services, contact Regency DRT today!